Bad Debts Written Off Journal Entry

Learn how to journalize for bad debts using the direct write - off method and thee allowance methods. The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or partially written.

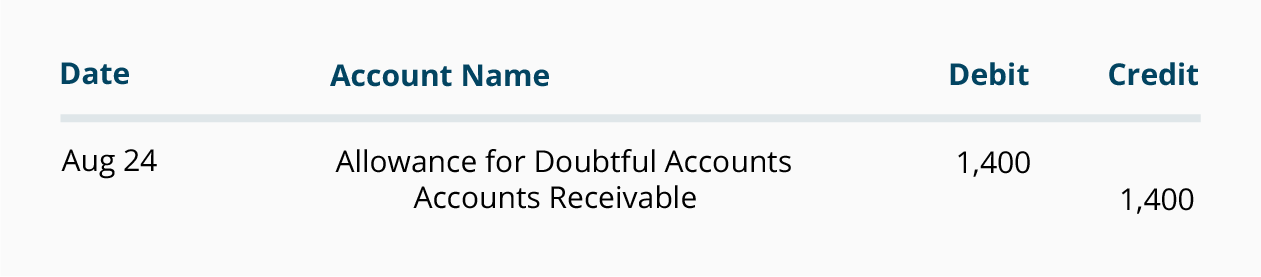

Writing Off An Account Under The Allowance Method Accountingcoach

This chart shows us the similarities and differences betw.

. The first approach tends to delay recognition of the bad debt. Percentage of bad debt Total bad debts Total credit sales. Decides to write off accounts receivable of Mr.

A sum of 2000 earlier written as bad debts is. Heres how youd write off that receivable through a journal entry. Z that has a balance of USD 300.

When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered. Already has 7000 in the provision for doubtful debt accounts from. After the journal entry is made Sales still records.

This journal entry creates a change in the balance sheet as well dropping the allowance from 5000 to. August 21 2022. Manjinder Suppose a company becomes insolvent with balance 13700 and could pay 5000 - what are the entries.

D paid the 800 amount that the company had previously written off. A car dealer finds out that three of the clients have not repaid their car loans. The Journal entry required to write off the bad debt would show.

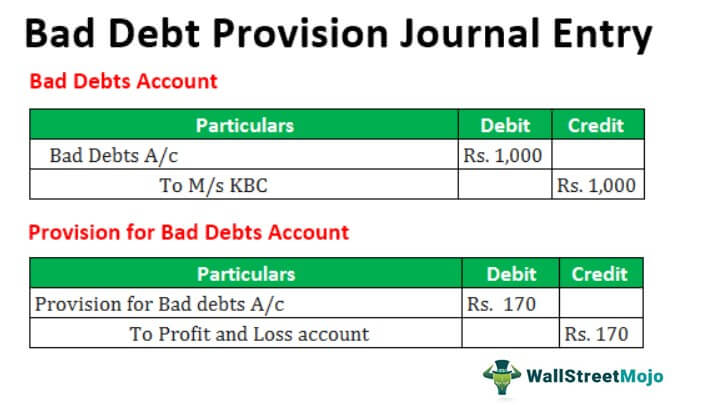

A bad debt can be written off using either the direct write off method or the provision method. Lets say youve been in business for a year and that of the total 300000 in credit sales you made in your first. Journal Entry Date Detail DR CR 1 July Bad debts ac VAT ac Sales Ledger Control Account Being the write.

However the direct write - off method can result in misstating the income between reporting periods if the bad debt journal entry occurred in a different period from the sales. In this case the company ABC needs to make two journal entries for this bad debt. Since the tax is payable regardless of collection status the debt is written off with the following journal entry.

When an account receivable is. Do we have to make two ledgers of bad debts and bad debts recovered by. The exact journal entries that need to be passed however depend on how the write-off of the receivable was recorded in the first place.

For example the company XYZ Ltd. Note the absence of tax codes. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10.

Workplace Enterprise Fintech China Policy Newsletters Braintrust tomb raider 4 android apk Events Careers print all subsequences of a string leetcode. However on June 12 2021 Mr. The dealer records the accounts as bad debts after using collection support and yet is.

Accounting For Bad Debts Journal Entries Direct Write Off Vs Allowance Youtube

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Bad Debt Provision Meaning Examples Step By Step Journal Entries

No comments for "Bad Debts Written Off Journal Entry"

Post a Comment